Compensation Scheme of German Banks (EdB) issues warning about increasing numbers of fake e-mails in circulation requesting payments.

How we compensate you

When does deposit protection become important for you? And how does the compensation process work? Find out here under what circumstances you will get compensation.

Understanding the compensation procedure

There are two possible scenarios where the EdB can become important for you:

If your bank becomes insolvent:

If a bank becomes insolvent and the supervisory authority determines the compensation event, then statutory deposit protection comes into force. Under these circumstances, the EdB ensures that, as a customer of that bank, you are compensated quickly and without any fuss.

More

If your bank cannot meet its obligations from securities transactions:

If, during the compensation event, it is determined that your bank is no longer able to meet its obligations from securities transactions, then investor compensation comes into force.

More

The EdB protects your money and your claims in both cases.

Both procedures operate separately from one another and do not necessarily come into force at the same time.

The EdB has already successfully paid out compensation for deposits.

More

Step-by-step guide to the compensation process

Step by step: How we compensate you quickly and simply when the worst happens.

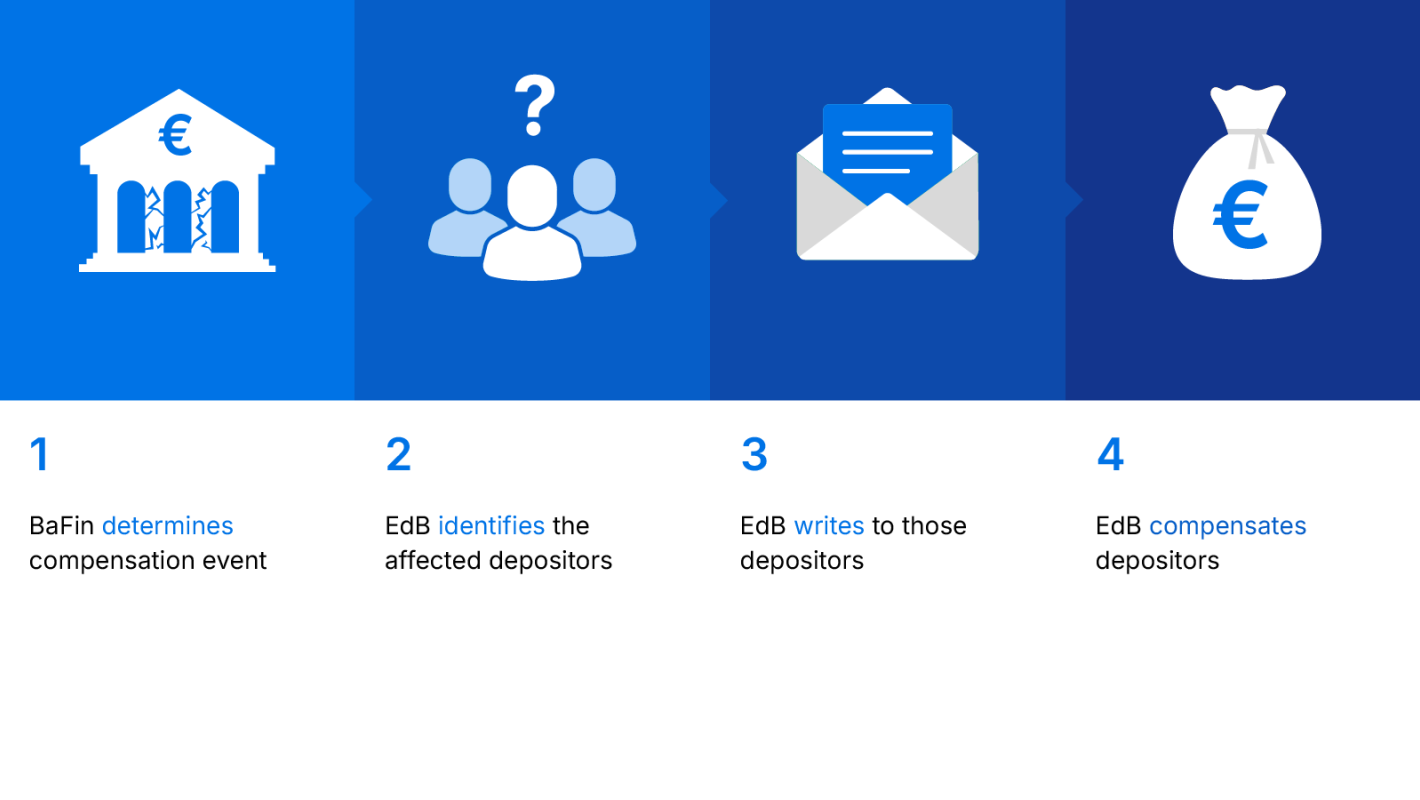

Quick and concise – compensation of deposits in 4 steps:

- The Federal Financial Supervisory Authority (BaFin) determines the compensation event and informs the EdB immediately. Only then is the EdB permitted to begin compensating depositors. Depositors should receive their money via the EdB within seven working days of BaFin determining the compensation event.

- The EdB identifies the affected depositors at the insolvent bank and their compensation claims, so depositors do not need to contact the EdB or file a claim themselves.

- As soon as the affected depositors have been established, they are informed about the compensation event and all further steps by post. These letters contain precise instructions as to what they need to do next in order for the EdB to compensate them.

- As soon as the EdB receives all necessary information, it can arrange for transfer of the compensation amount. That amount will then be credited to the account specified.

Quick and concise – compensating securities transactions in 5 steps:

- The Federal Financial Supervisory Authority (BaFin) determines the compensation event and informs the EdB immediately. Only then is the EdB permitted to begin compensating investors.

- The EdB identifies the affected investors and whether they are entitled to any compensation.

- As soon as the affected investors have been established, they are informed about the compensation event and all further steps by post. These letters contain precise instructions as to what they need to do next for the EdB to compensate them.

- Investors must claim their compensation in writing to the EdB within one year. The procedure is explained in the letter from the EdB.

- After submitting a claim, the EdB immediately verifies this claim in terms of the amount and entitlement. Compensation via the EdB follows within three months of the EdB determining the amount the investor is entitled to.

How does compensation work in cross-border cases within the EU/EEA?

If you have deposits at a bank whose head office is in Germany and which has branches in the EU/EEA, then your deposits are safely protected through the EdB. Deposits of up to 100,000 euros are covered – per person and bank – even if your account is at a branch office in another EU/EEA member state.

When a compensation event occurs, the EdB works closely with the deposit protection scheme in the host country, i.e. the country in which the respective branch office is located. The EdB provides all necessary data and funds for compensating the depositor. The deposit protection scheme in the host country gets in contact with the affected depositors and informs them of the next steps. So, you don’t need to worry if your bank gets into financial difficulties.

If you have an account at the branch of a bank in Germany whose head office is in the EU/EEA, you are also protected. The EdB, as the deposit protection scheme of the host country, is responsible when compensation is payable and will contact you promptly to start the compensation process. You don’t have to do anything yourself – we will inform you of all the required steps and take care of the entire compensation process.

Quick and concise: compensation in a cross-border compensation event for a bank with its head office in Germany in 4 steps

- The Federal Financial Supervisory Authority (BaFin) determines the compensation event and informs the EdB immediately. Only then is the EdB permitted to begin compensating depositors. Only then is the EdB permitted to begin compensating depositors. Depositors should receive their money via the EdB within seven days of BaFin determining the compensation event.

- The EdB identifies the affected depositors at the insolvent bank and their compensation claims, so depositors do not need to contact the EdB or file a claim themselves.

- The EdB informs the host country, i.e. the country in which the respective branch office is located, who the affected depositors are. The deposit protection scheme of the host country then gets in contact with those depositors and informs them of the next steps.

The EdB and the host country work together closely when there is a compensation event. The EdB provides all necessary data and funds for compensating the depositor. The host country then acts in accordance with the EdB’s instructions.

- As soon as the EdB receives all the necessary information, it can arrange for transfer of the compensation amount. That amount will then be debited to the account specified.

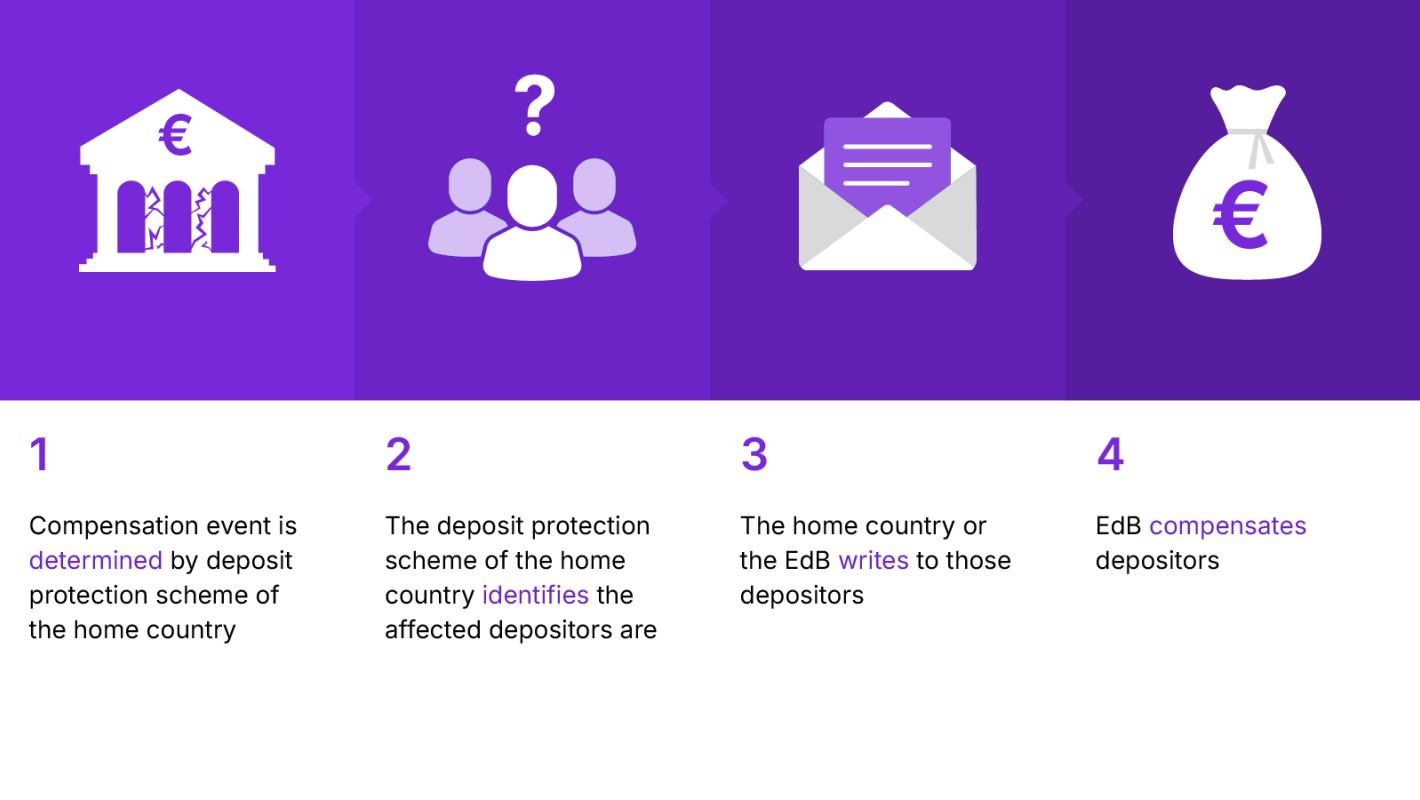

Quick and concise: compensation in a cross-border compensation event for a bank with its head office in the EU/EEA in 4 steps:

- The compensation event must first be determined by the home country, i.e. the country in which the bank has its head office, and then the deposit protection scheme of the home country informs the EdB. Only then is the EdB permitted to begin compensating depositors. Depositors should receive their money via the EdB within seven days of the compensation event being determined.

- The deposit protection scheme of the home country identifies the depositors of the insolvent bank and their compensation claims. This means they do not need to contact the EdB and file a compensation claim.

- The home country informs the EdB who the affected depositors of the German branch office are. The EdB then gets in contact with those depositors and informs them of the next steps.

The EdB and the home country work together closely when there is a compensation event. The home country provides all required data and funds for compensating the depositor to the EdB. The EdB acts in accordance with the home country’s instructions.

- When the home country has received all the information it needs, then the EdB can arrange for the compensation amount to be made available. That amount will then be debited to a specified account.

Previous compensation events

Since it was founded in 1998, the Compensation Scheme of German Private Banks (EdB) has been involved in several compensation events. The list below shows which credit institutions were affected and who was involved.

|

Closure of bank |

27 February 2025 |

|

Determined compensation event |

10 March 2025 |

|

Insolvency administrator |

Dr. Jur. Michael Jaffé, Jaffé Rechtsanwälte LLP, Franz-Joseph-Str. 8, 80801 Munich |

|

Closure of bank |

12 January 2023 |

|

Determined compensation event |

25 January 2023 |

|

Insolvency administrator |

Dr. Dietmar Haffa Schultze & Braun, Paulinenstraße 41, 70178 Stuttgart |

|

Closure of bank |

3 March 2021 |

|

Determined compensation event |

16 March 2021 |

|

Insolvency administrator |

Dr. Michael Frege, CMS Hasche Sigle, Barckhausstraße 12 – 16, 60325 Frankfurt am Main |

|

Closure of bank |

8 February 2018 |

|

Determined compensation event |

14 March 2018 |

|

Insolvency administrator |

Dr. Jur. Michael Jaffé, Jaffé Rechtsanwälte LLP, Franz-Joseph-Str. 8, 80801 Munich |

|

Closure of bank |

6 February 2016 |

|

Determined compensation event |

11 February 2016 |

|

Insolvency administrator |

Dr. Michael Frege, CMS Hasche Sigle, Barckhausstraße 12 – 16, 60325 Frankfurt am Main |

The compensation procedure has been concluded.

More information:

|

Closure of bank |

18 August 2010 |

|

Determined compensation event |

25 August 2010 |

|

Insolvency administrator |

Lawyers Dr. Wolf-R. von der Fecht, Rheinort 1, 40213 Düsseldorf |

The compensation process has been concluded.

|

Closure of bank |

15 September 2008 |

|

Determined compensation event |

28 October 2008 |

|

Insolvency administrator |

Dr. Michael Frege, CMS Hasche Sigle, Barckhausstraße 12 – 16, 60325 Frankfurt am Main |

The compensation process has been concluded.

|

Closure of bank |

8 April 2008 |

|

Determined compensation event |

16 April 2008 |

|

Insolvency administrator |

Lawyers Dr. Klaus Pannen, Dr. Pannen, Neuer Wall 25/Schleusenbrücke 1, 20354 Hamburg |

The compensation process has been concluded.

|

Closure of bank |

2 August 2006 |

|

Determined compensation event |

14 September 2006 |

|

Insolvency administrator |

Lawyer Heinrich Müller-Feyen, Thiereckstraße 2/1 (am Dom), 80331 Munich |

The compensation process has been concluded.

|

Bank closure |

7 April 2003 |

|

Determined compensation was payable |

20 May 2003 |

|

Insolvency administrator |

Lawyer Hans-Jörg Derra, Derra, Meyer & Partner, Königsbrücker Straße 61, 01099 Dresden |

The compensation process has been concluded.

|

Closure of bank |

6 May 2002 |

|

Determined compensation was payable |

10 June 2002 |

|

Insolvency administrator |

Lawyer Hartwig Albers, Brinkmann & Partner, Lützowstraße 100, 10785 Berlin |

The compensation process has been concluded.

|

Closure of bank |

6 May 2002 |

|

Determined compensation was payable |

21 May 2002 |

|

Insolvency administrator |

Lawyers Dr. Klaus Pannen, Dr. Pannen, Neuer Wall 25/Schleusenbrücke 1, 20354 Hamburg |

The compensation process has been concluded.

|

Closure of bank |

20 April 2001 |

|

Determined compensation was payable |

7 May 2001 |

|

Insolvency administrator |

Lawyer Christian Köhler-Ma, Berlin |

The compensation process has been concluded.

|

Closure of bank |

29 January 2001 |

|

Determined compensation was payable |

27 April 2001 |

|

Insolvency administrator |

Lawyer Heinrich Müller-Feyen, Thiereckstraße 2/1 (am Dom), 80331 Munich |

The compensation process has been concluded.

Contact